Unveiling CyberArk Stock First Quarter Financial Triumph

In the realm of US stocks, CyberArk Software Ltd. (CYBR) Q1 2024 financial performance presents a compelling narrative of growth and resilience. By delving into the key metrics, investors can gain valuable insights into CyberArk’s revenue surge, profitability, and strategic outlook in the cybersecurity domain.

Revenue Surge: Unveiling CyberArk Revenue Dynamics

CyberArk Stock (CYBR) Q1 2024 results exceeded expectations, showcasing remarkable growth across various revenue streams. With subscription revenue witnessing a robust 69% increase and overall revenue climbing by 37%, CyberArk demonstrates its prowess in catering to evolving cybersecurity needs amidst escalating digital threats.

Analyzing CyberArk Stock Profit Metrics

CyberArk profitability metrics paint a promising picture, with net income witnessing a significant turnaround from GAAP losses to substantial earnings. This transformation underscores CyberArk’s ability to leverage operational efficiency and capitalize on burgeoning demand for cybersecurity solutions.

Operational Strength: Exploring CyberArk’s Operational Resilience

Amidst the dynamic cybersecurity landscape, CyberArk’s operational resilience shines through, evident in its impressive cash flow from operating activities. With a net cash position of $1.4 billion as of March 31, 2024, CyberArk is well-positioned to fuel its growth initiatives and capitalize on emerging market opportunities.

Strategic Initiatives: CyberArk’s Path to Continued Success

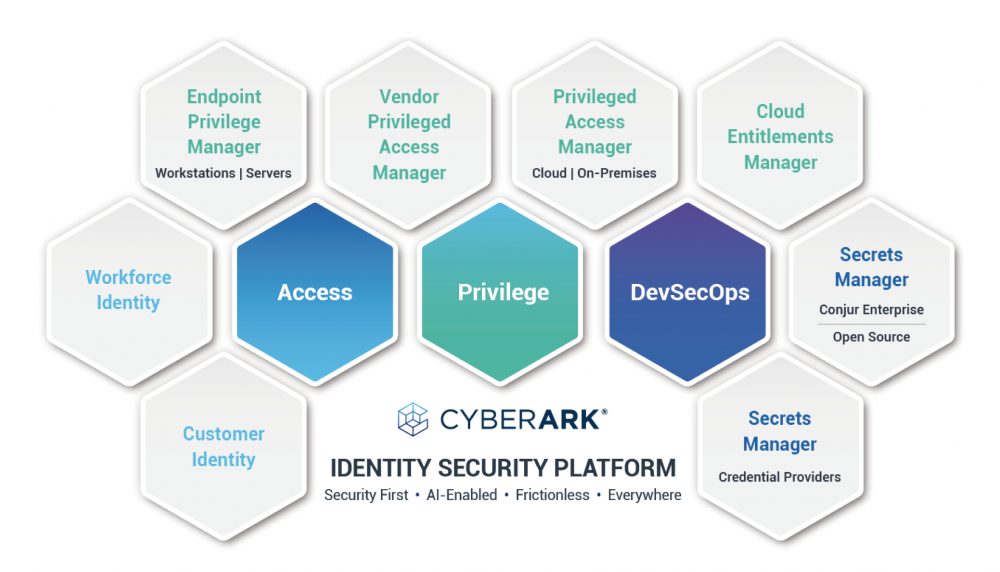

CyberArk’s strategic endeavors, including the launch of innovative products like CyberArk Secure Browser and CyberArk MSP Console, underscore its commitment to staying ahead of the curve. Additionally, initiatives such as achieving FedRAMP® authorization further solidify CyberArk’s position as a trusted cybersecurity partner for government and enterprise clients alike.

Unlocking Future Potential: CyberArk Outlook for Q2 2024 and Beyond

As CyberArk (CYBR) navigates the remainder of 2024, its outlook remains optimistic, with revenue forecasts indicating sustained growth and profitability. With a strong focus on innovation, customer-centricity, and market expansion, CyberArk Stock is poised to continue delivering value to shareholders and clients in the ever-evolving cybersecurity landscape.

Discovering the Most Promising Stocks to invest in

Interested in maximizing your investment potential in the cybersecurity sector? Unlock the power of informed decision-making with Profitsforce. Explore subscription plans tailored to your investment needs and gain access to exclusive insights on the most promising stocks to invest in.

- Securing the Future: Okta’s Role in Cybersecurity

- Protecting Data with SentinelOne: A Reliable Investment in Cybersecurity

- AI-Powered Cybersecurity Leader Redefining Industry Standards

- Cybersecurity Investments

- Why Did Elon Musk Delay His India Visit?