Are you ready to start investing with the right approach?

Open the door to new opportunities!

Try our products and subscriptions today, providing your investments with a reliable assistant.

Feel the difference – together we can do more!

SALE

Exclusive Top Stocks – Now or Never!

News

·

RTX reported revenue of $69 billion in Q4 2023, falling short of forecasts, but with earnings per share (EPS) of $2.23 surpassing expectations by 3.1%. Analysts now predict robust growth for RTX in 2024, with revenue projected to reach $78.6 billion and EPS expected to rise to $4.26. Revenue Projection and Analyst Expectations Analysts are…

·

Netflix (NFLX) reported earnings of $2.11 per share in the fourth quarter of 2023, slightly below expectations. However, the revenue of $8.83 billion marked a 3.4% YoY increase, surpassing forecasts. Global Subscribers Surge: Strengthening Market Presence In Q4, Netflix gained 13.12 million paid subscribers globally, up from 7.66 million in the same quarter the previous…

·

Explore the stellar performance of US stocks in 2023 with a deep dive into Johnson & Johnson’s (JNJ) recent financial report for the fourth quarter and the entire year of 2023. As the world’s largest medical company specializing in pharmaceuticals, medical equipment, diagnostics, and consumer health, JNJ reported substantial quarterly and annual sales growth, accompanied…

·

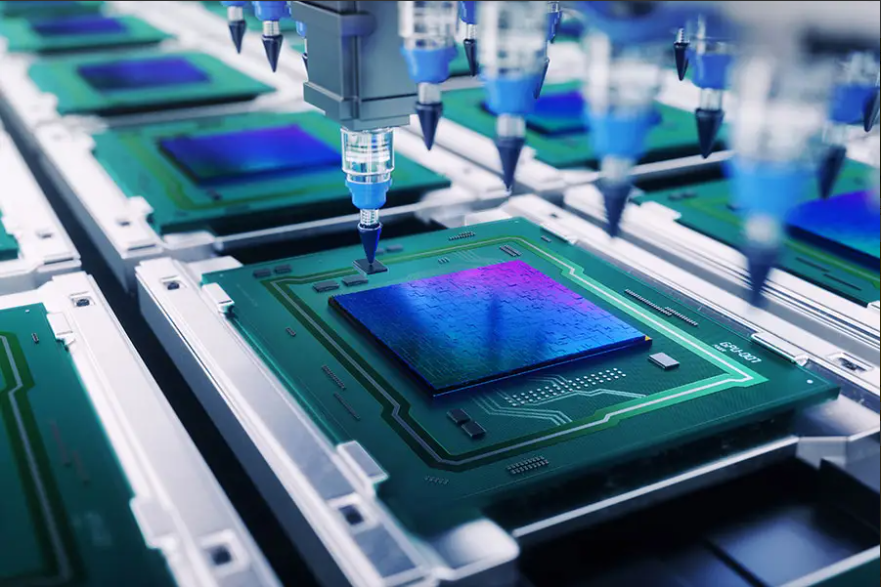

Investors are celebrating Taiwan Semiconductor (NYSE: TSM) fourth-quarter earnings report, signaling a return to revenue growth in the semiconductor sector after a cyclical slowdown. While Q4 results were relatively modest, they surpassed estimates, boosting TSMC’s momentum. Navigating Post-Pandemic Challenges After the pandemic-induced slump in demand for electronics like computers and an oversupply of chips, most…

·

Investing in US stocks is a dynamic venture, and ON Semiconductor, based in Arizona (NASDAQ:ON), stands out as a key player in the semiconductor market. Our analysis reveals ON as a prominent supplier of microchips, specializing in power and signal management, logical, discrete, and custom devices for various applications, including automotive, communication, computing, consumer, industrial,…

·

In the dynamic world of US stocks, KeyCorp (KEY) recently reported a Q4 2023 revenue of $1.53 billion, marking a 19% decline from the previous year. Despite this, the company exhibited an unexpected 13.64% growth in earnings per share (EPS), surpassing analysts’ expectations. A Closer Look at KeyCorp Net Margin The net margin stood at…

·

As Starbucks navigates the post-COVID landscape, delve into our comprehensive investment guide for 2024. Discover the growth projections, financial strategies, and unique loyalty programs that make Starbucks a compelling choice for investors. Loyalty Programs: A Key Element for Investor Success Stand out in the investment landscape by understanding the impact of Starbucks’ loyalty programs. With…

·

The renowned investment company Berkshire Hathaway, led by Warren Buffett, has strategically invested in homebuilders. D.R. Horton (NYSE: DHI), the largest US homebuilder, appears poised for continued growth in 2024. Favorable Macroeconomic Landscape for Homebuilders The current macroeconomic situation continues to favor housing developers. High mortgage rates have tempered demand, and existing homeowners are reluctant…

·

In the dynamic world of US stocks, Tesla (TSLA) recently released its Q4 2023 report, sparking interest and concern among investors. Let’s delve into the key highlights and challenges that could influence the US stocks market. Revenue and Growth Insights Tesla’s Q4 2023 revenue reached $25.2 billion, reflecting a 3% annual growth. However, this fell…

·

In the dynamic landscape of aviation, Boeing, Airbus, and other aircraft manufacturers are fervently seeking avenues to ramp up production and deliveries, addressing setbacks caused by the pandemic and challenges in rolling out new models. In the current reality, escalating production volumes stand as the sole chance for the aviation sector’s financial recovery. Hexcel’s Advanced…

·

MercadoLibre stands tall as the largest e-commerce and digital payment company in Latin America, generating a significant portion of its revenue from Brazil, Mexico, and Argentina. Since going public in 2007, its stocks have skyrocketed by approximately 8,340%, driven by the expansion of its logistics network across challenging terrains in Latin America and the increasing…

·

LVMH stands tall as the global leader in crafting high-end luxury goods, boasting an impressive portfolio of 75 renowned brands, including Louis Vuitton, Dior, Fendi, Tiffany & Co., Bulgari, and Sephora. These brands have not only weathered economic downturns but have also thrived during periods of growth. Unlike mid-tier luxury brands that heavily rely on…