Why Nvidia Stock Still Has Massive Growth Potential — Despite the Sell-Off

Even amid market-wide volatility and tech sector pullbacks, Nvidia (NVDA) continues to stand out as one of the most promising long-term growth stocks. While many investors panic during short-term downturns, those with a long-term perspective are eyeing Nvidia’s fundamentals — and they’re seeing something different:

“A company that’s not just surviving the correction — but preparing for its next massive leap forward.”

Market Shock Doesn’t Change Fundamentals

Recent macroeconomic pressures and broader tech sell-offs have pushed some investors to reduce their exposure to high-growth names. But while Nvidia’s stock price has cooled from recent highs, its core growth thesis remains intact — and possibly stronger than ever.

One key metric points to that strength:

PEG Ratio Below 0.5

The PEG ratio (Price-to-Earnings divided by Growth) adjusts for future earnings expansion. A PEG under 1 is generally considered undervalued. At under 0.5, Nvidia’s stock is signaling serious upside potential — even after massive gains over the past two years.

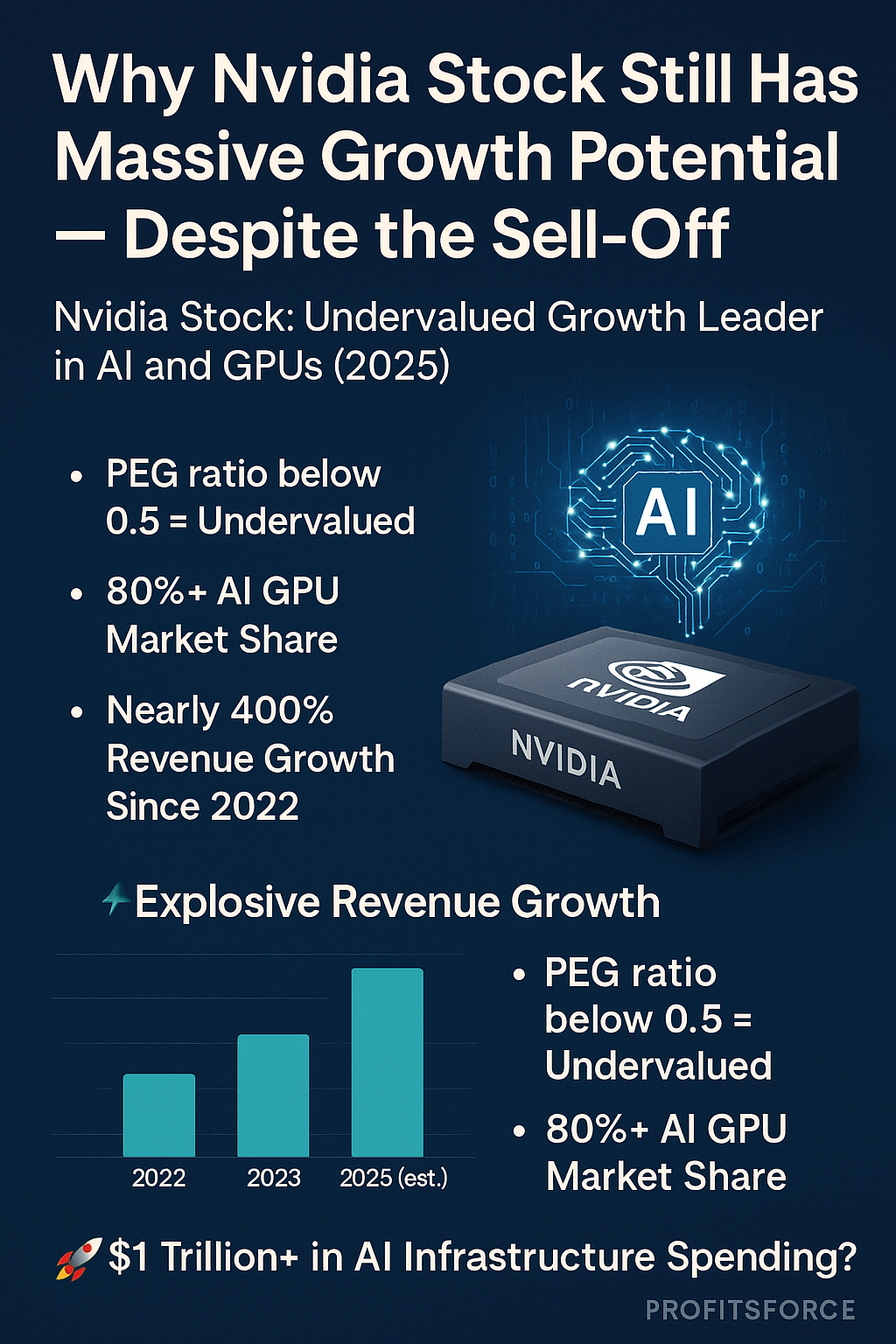

Nvidia’s Explosive Revenue Growth

- Nearly 400% revenue growth since 2022

- Dominant position in the GPU market with over 80% share

- Core supplier to global AI infrastructure

According to analysts, this isn’t a temporary spike — it’s the beginning of a sustained growth cycle.

“AI demand is not seasonal. It’s structural.” – ProfitsForce Insights, 2025

Why GPUs = The Backbone of the AI Revolution

Nvidia’s leadership isn’t just about hardware — it’s about owning the AI development stack.

- Its CUDA platform is now the industry standard for developers building AI models

- Major tech firms — Microsoft, Meta, Google, OpenAI — rely on Nvidia’s chips

- Demand for AI compute power is expected to grow exponentially through 2030

“AI is not a trend — it’s the next industrial revolution.” – Nvidia

$1 Trillion+ in AI Infrastructure Spending Ahead?

Nvidia estimates that by 2028, the total spend on AI data center infrastructure could exceed $1 trillion, including:

- GPU hardware

- Server clusters

- AI optimization software

- Cloud integrations

And Nvidia is at the center of all of it.

Nvidia by the Numbers (2025 Outlook)

| Metric | Value |

|---|---|

| PEG Ratio | < 0.5 |

| AI GPU Market Share | 80%+ |

| Revenue Growth (2-year) | ~400% |

| CUDA Developer Base | 4M+ |

| Data Center Segment (2024) | $35.6B+ |

| Projected AI Infra Spend (2028) | $1 Trillion+ |

Frequently Asked Questions (FAQ)

Why is Nvidia’s PEG ratio important?

The PEG ratio compares a company’s price-to-earnings with its earnings growth. Nvidia’s PEG under 0.5 suggests it’s significantly undervalued relative to its projected growth — a rare sign of strong upside potential.

Is Nvidia still a good investment after its recent rally?

Yes. Despite volatility, Nvidia’s fundamentals — including dominant AI GPU market share and rapid data center revenue growth — remain strong. Long-term demand for AI chips continues to expand.

What is CUDA, and why does it matter?

CUDA is Nvidia’s proprietary developer platform for GPU computing. It has become the standard toolset for AI developers globally, reinforcing Nvidia’s ecosystem and competitive moat.

What are the risks of investing in Nvidia?

Potential risks include high valuation, supply chain pressures, or competition from in-house chip projects by large tech firms. However, Nvidia’s scale and momentum provide resilience.

How much is expected to be spent on AI infrastructure?

Nvidia forecasts that by 2028, over $1 trillion will be spent on AI data center infrastructure — a space where Nvidia is the leading hardware and software supplier.

ProfitsForce Insight

Nvidia remains one of the most powerful forces in the global tech market. While stock corrections shake out short-term traders, long-term investors are focused on fundamentals:

- Strong margins

- Explosive demand

- Industry leadership

- PEG under 0.5 = undervaluation

This is not a company resting on past wins — it’s building the infrastructure of the next decade.

Ready to Invest in the Future?

Get early access to stock picks and AI growth analysis from ProfitsForce. Subscribe to ProfitsForce→

- 5 Common Mistakes Beginner Investors Make When Investing in Stocks

- How Will Nvidia Stocks Continue to Surge in the Competitive Market?

- How to Use Stock Market Trends to Predict Future Growth

- Is Now the Right Time to Invest in CrowdStrike?