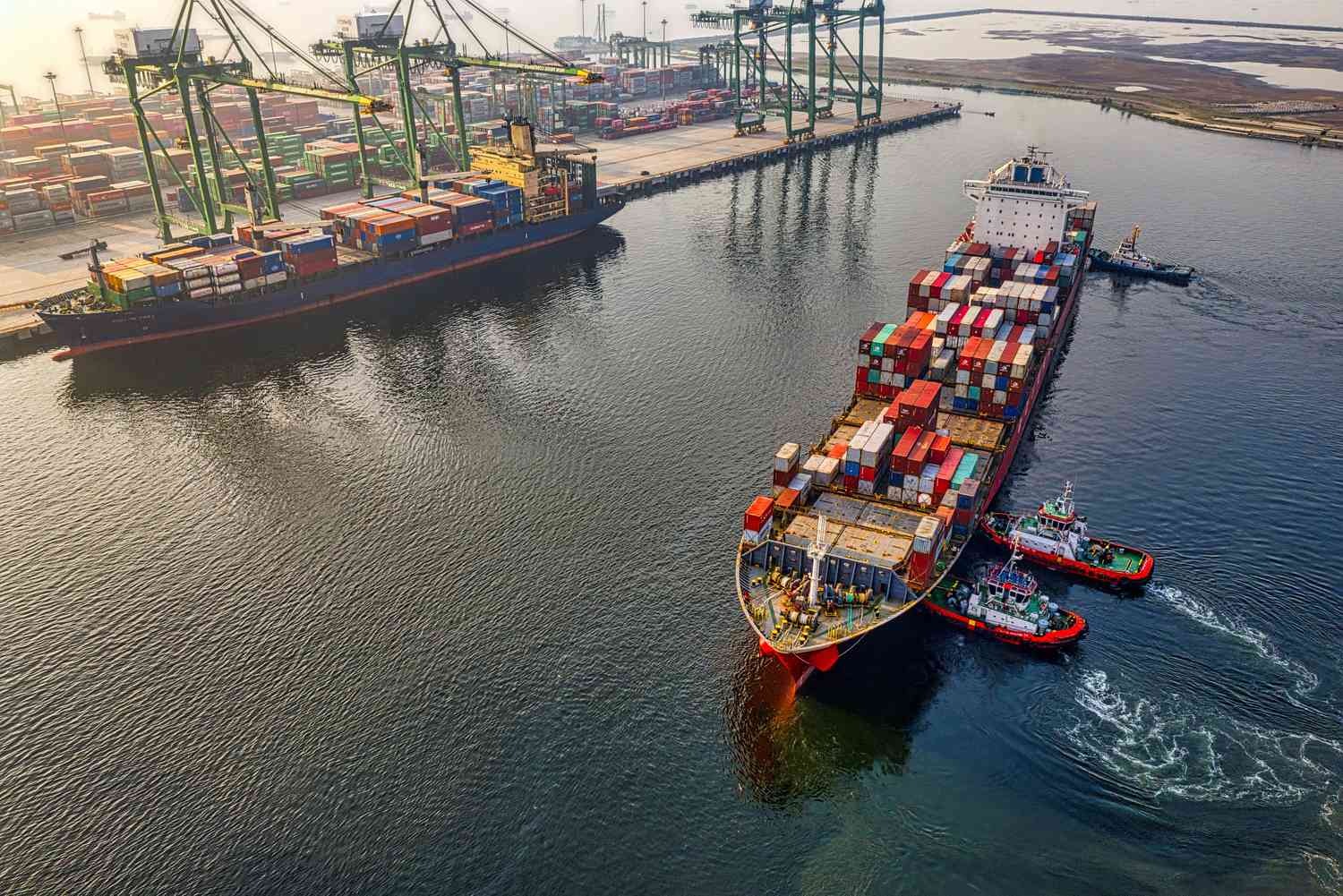

The global transportation sector is experiencing remarkable growth, driven by escalating tensions in the Red Sea. This has led to a shortage of containers and a substantial increase in freight costs. Notably, Maersk (MAERSK-A.CO, MAERSK-B.CO) shares have surged by an impressive 37% since mid-December. The surge in prices follows rebel attacks, compelling Danish carriers and other shipping companies to temporarily alter shipping routes around the waters connected to the Suez Canal, the shortest route between Asia and Europe.

Analysts Predict Upsurge in Maritime Carriers’ Stocks

In anticipation of higher revenues resulting from reduced capacity and increased transport expenses, analysts have adjusted their stock value forecasts for maritime carriers. Recent estimates reveal that over half of the ships have changed their routes, lengthening their voyages by 30%. This strategic shift in the industry is influencing stock projections for key players.

Surge in Shipping Costs between Asia and Northern Europe

The cost of shipping between Asia and Northern Europe has seen an unprecedented increase of 173% since mid-December, as reported by Freightos terminal data. German freight giant Hapag-Lloyd (HLAG.DE), announcing its decision to circumvent the Suez Canal, has witnessed substantial growth of over 65% since mid-December. The evolving dynamics of global shipping routes are reshaping the market and impacting major players.

Remarkable Growth of Key Players in the Shipping Industry

ZIM Integrated Shipping (ZIM), serving ports in the Eastern Mediterranean and Israel, has demonstrated a remarkable growth rate of over 70% during the same period. Athens-based dry bulk carrier Star (SBLK) has experienced a 10% increase in shares since mid-December. Simultaneously, smaller shipping companies like Navios Maritime Partners and Global Ship Lease (GSL) have observed growth of 16% and 14%, respectively. This highlights the diverse impact of changing shipping dynamics on various players in the industry.

Explore Investment Opportunities with ProfitsForce

Amid the evolving dynamics of the shipping industry, explore promising investment opportunities. Understand the influence of these changes on key industry players and navigate market trends effectively. Stay informed with the latest US stocks news, market analytics, and investment strategies by relying on ProfitsForce as your trusted resource.