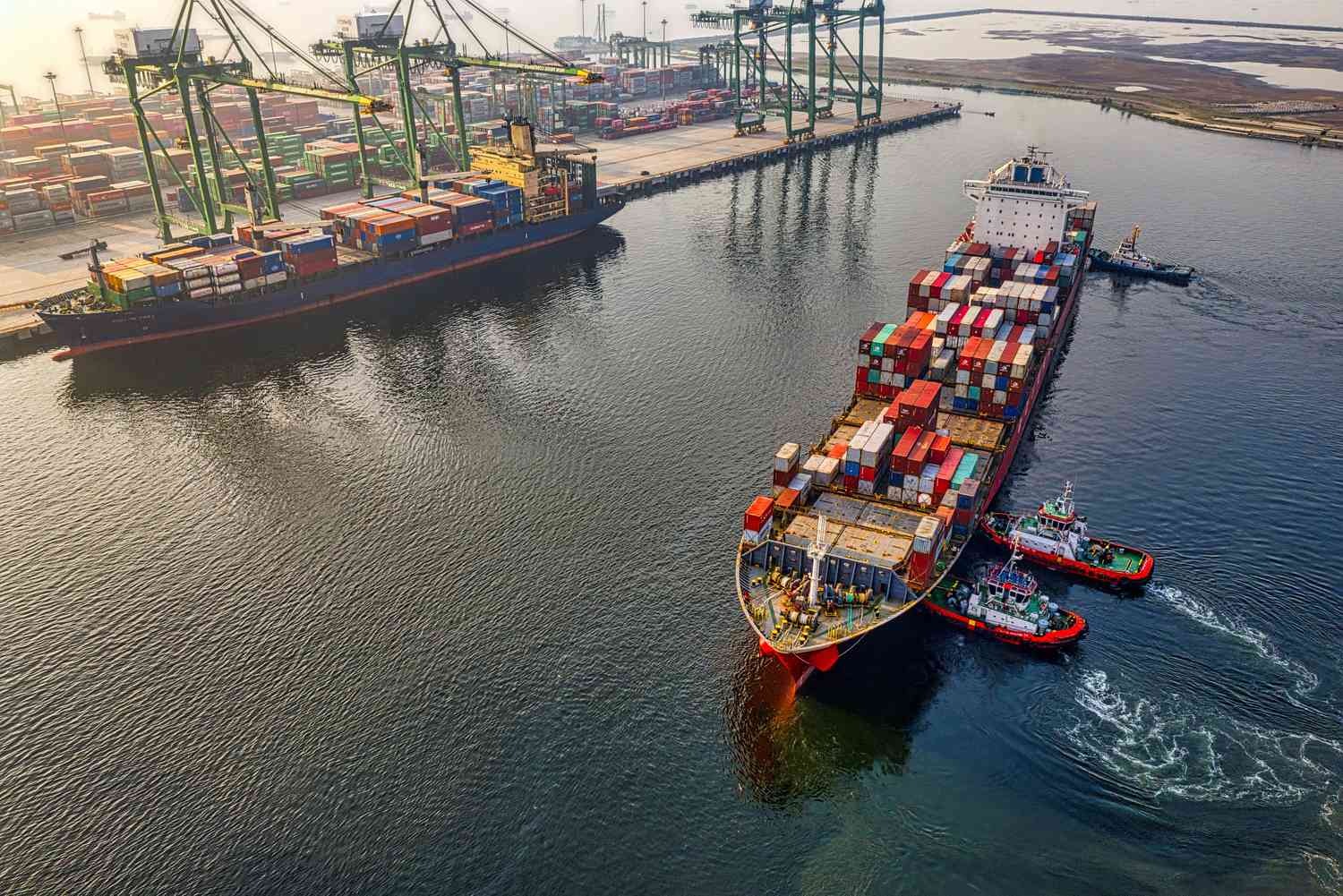

The heightened tensions in the Middle East and disruptions in maritime shipping routes are prompting investors to pay increasing attention to shipping company stocks operating in the Red Sea.

Growing Transport Demands

Transportation stockpiles are increasing as tensions in the Red Sea have led to reduced container availability and rising freight costs.

Impact on Maersk and Other Companies

Shares of Maersk (MAERSK-B.CO) surged by 37% since mid-December after attacks by Houthi rebels forced the Danish carrier and other shipping companies to temporarily halt or divert vessels from waters connected to the Suez Canal — the shortest route between Asia and Europe. Analyst ratings for shipping companies like Maersk have been significantly upgraded.

Route Changes and Supply Chain Disruptions

The rerouting of ships from Suez through Cape Town in response to recent attacks on commercial vessels in the Red Sea significantly reduces container vessel capacity. Analyst estimates indicate that as of last month, 70-80% of ships have altered routes, increasing the duration of their voyages by 30%. This could lead to supply chain disruptions and substantial increases in transportation costs, particularly in trade between Asia and Europe.

Surging Transportation Costs

According to Freightos terminal data, transportation costs between Asia and Northern Europe have already surged by 173% since mid-December.

Market Response to Alternative Routes

Shares of the German freight giant Hapag-Lloyd (HLAG.DE), which stated it would not be routing vessels through the Suez Canal, have risen by over 65% since mid-December. Meanwhile, shares of ZIM Integrated Shipping (ZIM), servicing ports in the Eastern Mediterranean and Israel, have grown by over 70% during the same period. Athens-based Star (SBLK) also saw a 10% increase in shares since mid-December, while shares of smaller shipping companies like Navios Maritime Partners and Global Ship Lease (GSL) have risen by 16% and 14% respectively.

As tensions persist in the Middle East and maritime routes face disruptions, investors are closely monitoring shipping companies for potential investment opportunities. Stay informed about market trends and investment strategies for US stocks like these through ProfitsForce’s analytical tools.